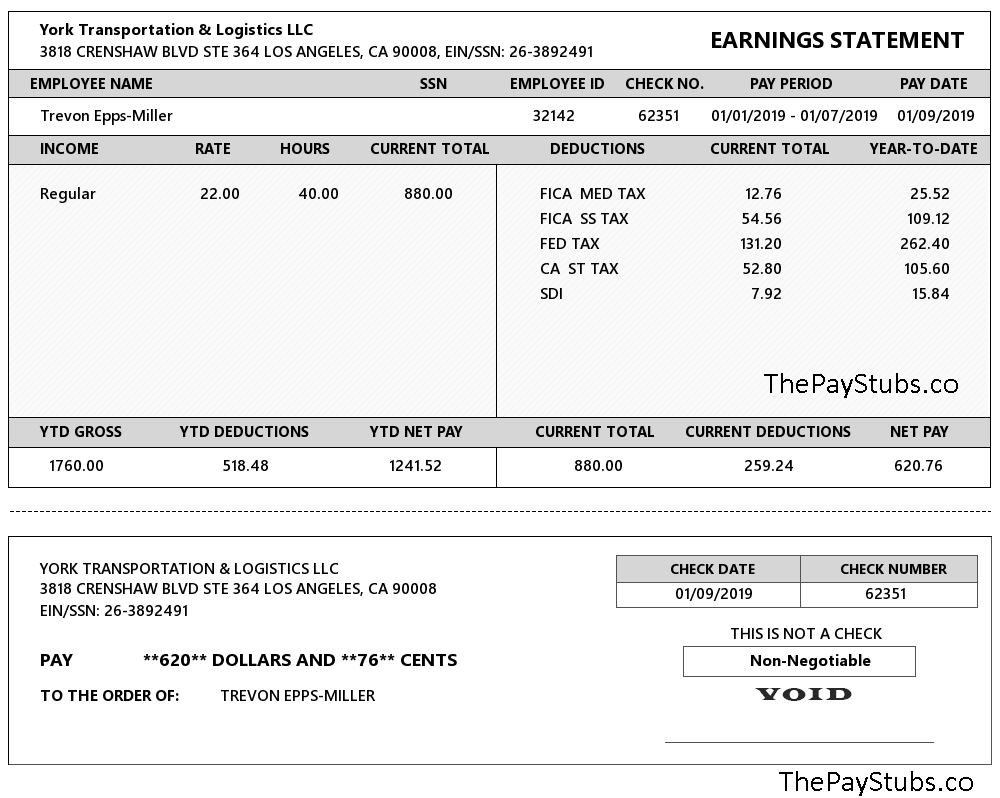

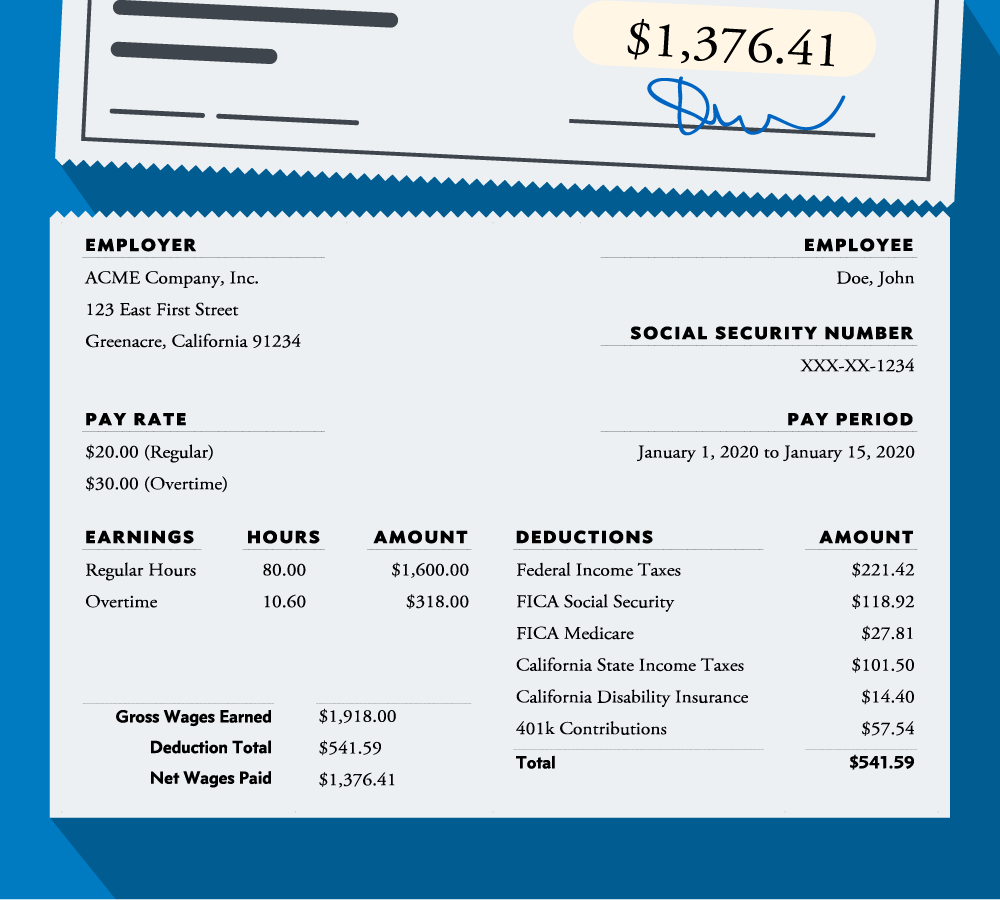

California Paystub Requirements 2025. Access to password protected and/or secure areas of this. A paystub is a breakdown of an employee’s earnings in a pay period.

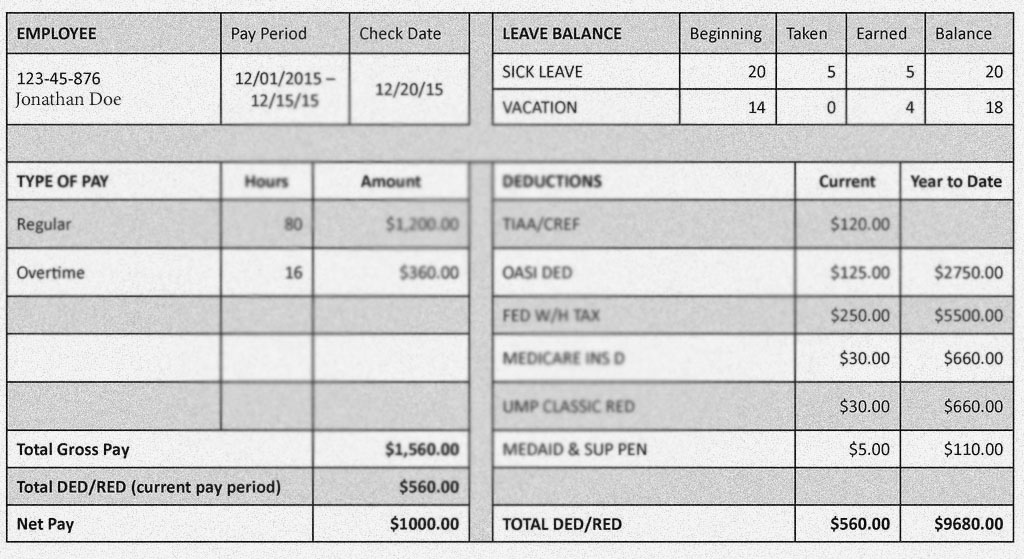

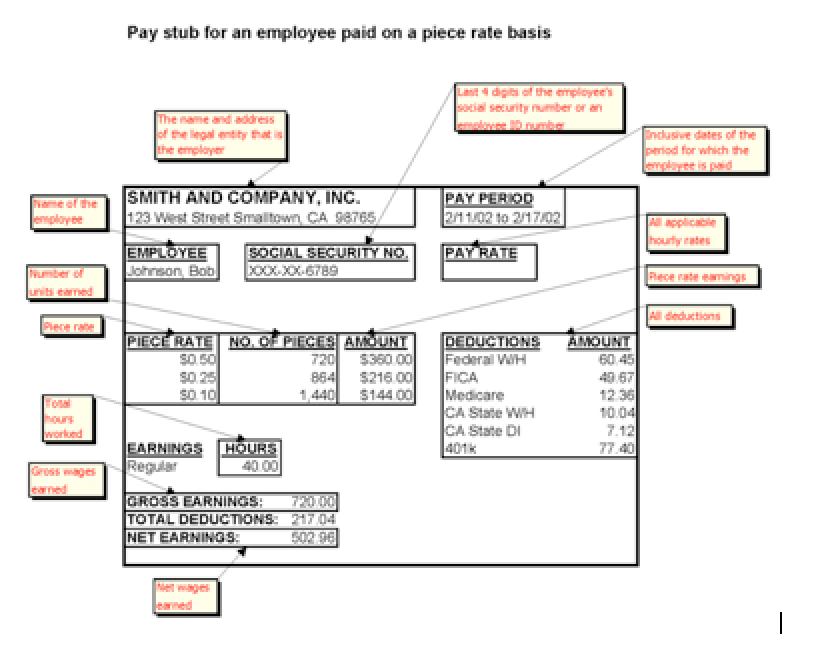

California labor code section 226(a) requires employers to include nine specific items on pay stubs, and the healthy workplace healthy family act added paid. As readers may know, california requires private employers of 100 or more employees and/or 100 or more workers hired through labor contractors to annually.

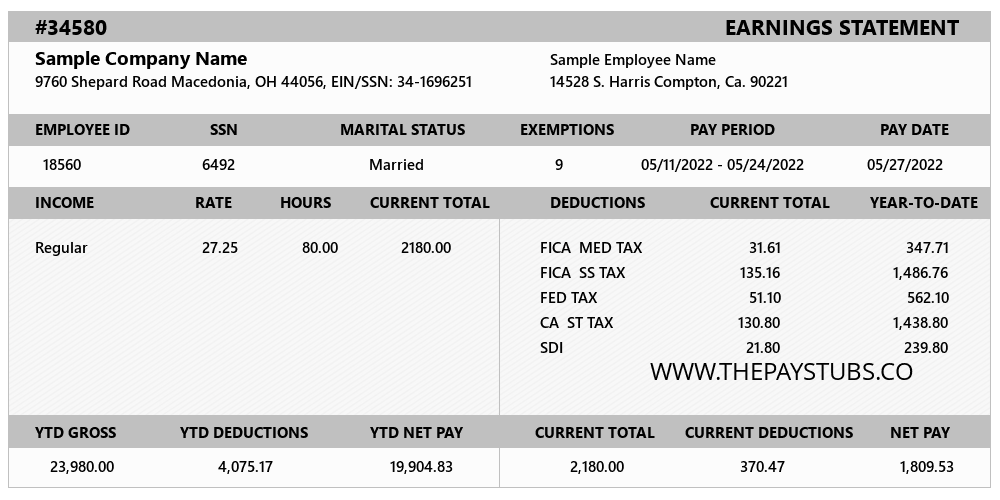

What Free Paycheck Stub Template Has Provided To The Employers And, California law requires specific information to be included on your pay stub (or wage statement) so that you have an accurate understanding of how your wages. California’s pay data reporting portal will open on february 1, 2025, and employers will be required to report on three new data points.

California Pay Stub Requirements Is Yours Compliant? PARRIS Law Firm, 2025 pay data reports are due 5/8/2025. 1 what are the pay stub requirements in california?

California Check Stub Generator Check Stub Maker CA, The reporting portal opened february 1, 2025, and the. A paystub is a breakdown of an employee’s earnings in a pay period.

Paystub Requirements Under California Labor Code Section 226 BakerLLP, Starting on january 1, 2025, employers must generally provide 5 days or 40 hours of paid sick leave to their employees in california. Although federal labor law does not require employers to provide pay stubs to employees, california paystub law requires employers give an.

Online Free Pay Stub (paycheck stub) Generator, In january 2025, california again updated its pay data reporting website for the 2025 reporting cycle. Additionally, the minimum compensation threshold for the computer software exemption, which is not tied to the minimum wage rate like the administrative,.

California Hourly Employee PayStub Generator, In january 2025, california again updated its pay data reporting website for the 2025 reporting cycle. California law requires private employers of 100 or more employees and/or 100 or more.

10+ Proof Of Wage Loss Paystub DyannCarina, In california, employers are legally required to include certain information on. California labor code §226 lists the information that employers must include on a california employee’s pay stub.

8 Employee Paycheck Stub Template SampleTemplatess SampleTemplatess, As readers may know, california requires private employers of 100 or more employees and/or 100 or more workers hired through labor contractors to annually. Posted on january 1, 2025.

California Pay Stub Requirements Top Class Actions, California labor code section 226(a) requires employers to include nine specific items on pay stubs, and the healthy workplace healthy family act added paid. In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in advance as regular paydays.

California law requires specific information to be included on your pay stub (or wage statement) so that you have an accurate understanding of how your wages.